In today’s world where most, if not all, salaries are agreed on a gross basis, many nannies and families still agree their salaries on a net basis. So what is the difference?

Net Salary

Net salary or take home pay does not include Tax, NI and pension contributions. Meaning that an employer needs to add these costs to agreed net wage.

The difficulty in agreeing to a Net wage is that the employer will not know exactly how much it will cost for them because the total amount is subject to change either by direct government policy of raising tax thresholds or HMRC sending a tax code allowance change.

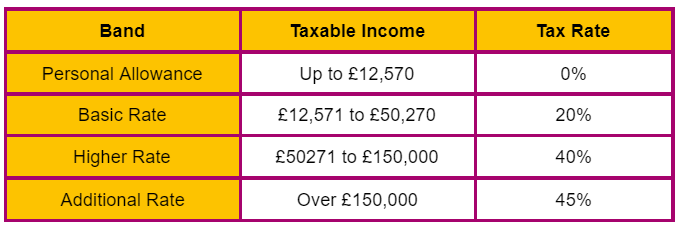

Tax threshold depend entirely on how many hours the nanny is working for the family (or elsewhere) The more hours the nanny works, the higher their salary. The higher the salary, the more tax is due on this salary. Below are the different tax rates for 2021:

Here is a simple example:

Net Salary is £11/ hr x 50hrs/week = £28,600/year for the nanny

Gross salary is £38,610/year (net + Employee National Insurance and Pension + Taxes)

Yearly cost to employer is £43,696 (+Employer National Insurance and Pension)

Now, let’s say that the nanny is babysitting a couple of hours in the evening every week and they end up working 60 hours.

That comes to almost £55,000 annually for the employer.

Also if this is a second employment position for the nanny, then the basic rate tax applies, meaning that secondary earnings are taxed with no tax free earnings.

This also does not take into account student loans that the nanny might have. With a net agreement the employer will have increased costs as the student loan will be paid by the employer and this will also increase tax and NI costs as this will increase the gross salary.

Gross Salary

For the majority of the working population, it is a given that the advertised salary for a role is a Gross salary. This means that the employer deducts Tax & NI from the gross salary and pays the employee the net (take home wage).

As we have seen above, even small changes in working hours, having more than one job or a student loan can make a big difference in the actual cost of employing a nanny. Therefore, agreeing a gross salary will give parents as employees peace of mind because the cost to them is set.

Not declaring taxes - i.e. paying your nanny cash in hand

It is compulsory for all UK employees to contribute a certain % of their earnings to the state through a PAYE scheme (Pay As You Earn).

Nannies should check that their employer has set up a Nanny PAYE scheme for them. If they have this set up, your payslips should display the Tax and NI amounts that are being paid to HMRC.

It’s a criminal offence not to contribute the correct amount of National Insurance and Tax for an employment and if caught doing this both the employer and nanny could face penalties. They can include:

- Repayments of any unpaid Tax and NI to HMRC plus interest

- Fines for lack of payments

- Criminal investigation with a risk of prosecution and imprisonment

While being paid ‘cash in hand’ can seem like an easy short term solution it is not worth the potential of long term difficulties down the line. Being paid in this way also means the nanny loses out on the rights as an employee - such as paid annual leave, sick pay, maternity pay, a pension scheme and redundancy or furlough pay. Another issue this can cause is that when applying for a mortgage or loan, lenders expect proof of earnings from at least the past 6 payslips.

Working as a self-employed nanny

As a rule nannies should not work on a self employed basis, but if a nanny has a series of multiple, temporary positions, it is possible that HMRC will grant some nannies a self-employed status.

For example this is a common set up for a maternity nurse who will often work several short term jobs each month with different families and therefore each family will pay the maternity nurse on a Gross wage and the nurse is then responsible to declare their income and pay the taxes due.

It is important to tell HMRC as soon as you start to work on a self employed basis so they can register you as a self employed worker. Additionally this needs to be done by 5th October after the end of the tax year during which you became self employed. For example if you started working as a self employed worker in January 2021 you would need to declare this by 5th October 2021.

Self employed workers are entitled to the same tax free personal allowance (the amount you can earn before paying tax) as employed workers. This is £12,570 in the tax year 2021/2022. If you’re self-employed you’re entitled to the same tax free personal allowance as someone who is employed.

Self employed workers will have to pay both tax and National Insurance contributions - just like employed workers. Every tax year a Self Assessment tax return must be submitted for the previous year and then the tax and National Insurance owed must be paid. It is important to remember to keep aside around 20% of any earnings to be able to make these contributions at the end of the tax year.

Similar articles

From Backpacks to Butterflies: Navigating the First Day of School

Ensure your child (and you!) have a great first day of school with our 7 recommendations.

Read post Back to all resources

Back to all resources